tax service fees fha loans

Lenders pass the tax service fee on to the buyer at closing. For example FHA rules allow the lender to collect an origination fee.

Fha Closing Costs What They Are And How Much They Cost Bankrate

The amount varies based on location and lender guidelines.

. FHA Loan Questions. What is a tax service fee FHA. The catch is the FHA funding.

Tax Service Fee 50 This fee is paid to. Home inspection fees up to. FHA is adding the Third Party.

A tax service fee for managing an escrow impound account is one such fee FHA homebuyers may not pay. At the Federal Housing Administration FHA we provide mortgage insurance on loans made by FHA-approved lenders nationwide. What is a tax service fee FHA.

Document preparation by a third party Property survey. Settlement Fees Required to Close The Deal. Tax Service Contract Underwriting Fee Administration Fee Photo Inspection Fee Recording Fee - Balance above 1700 Termite Fees or Work Charges Any Messenger Fee incl.

Effects Before FHAs elimination of most non-allowable closing costs FHA borrowers were at a disadvantage when competing for. A tax service fee is paid by mortgage borrowers to mortgage lenders to ensure that a mortgaged propertys property taxes are paid on time. The servicing company sets up an escrow account for the buyer and pays the buyers taxes and.

The interest rate on the CalHFA FHA is fixed. What is a tax service fee FHA. Tax Service Fee 50 This fee is paid to research the existing property taxes for the property and to see whether the taxes have been.

The tax service fee is typically paid by the buyer to the lender at the time the home is purchased. Kukwa explained that in New Jersey the tax service fee is typically two to three months worth of property taxes. The gist of the questioncan an FHA loan applicant be charged a tax service fee as part of closing costs or other loan-related fees and expenses.

Credit reports actual costs Transfer stamps recording fees and taxes. The CalHFA FHA program is a first mortgage loan insured by the Federal Housing Administration. CalHFA works through and uses approved.

The seller or lender must pay the non-allowable tax service fee which typically costs about 25 to 75 according to the Good Mortgage website. A reader got in touch with us recently to ask a question about the allowable fees and expenses associated with FHA new purchase home loans also known as forward mortgages. As part of the US.

FHA loans are mortgages insured by the Federal Housing Administration the largest mortgage insurer in the world. Definition Simply put a tax service fee is paid to the company that services the loan. A tax service fee directly benefits the loan servicing company or the.

Tax Service Fee Ð 50 This fee is paid to research the existing property taxes for the property and to see whether the taxes have been paid to date or if they. The gist of the questioncan. The seller or lender must pay the non-allowable tax service fee which typically costs about 25 to 75 according to the Good Mortgage website.

Tax service fees are closing costs that are assessed and collected by a lender as a means of making sure that mortgage holders pay property taxes in a timely manner. What is a Tax Service Fee. The one percent fee cap was eliminated.

For loans through the end of 2009 the origination fee was limited to one percent. Test and certification fees. The seller or lender must pay the non-allowable tax service fee which typically costs about 25 to 75 according to the Good Mortgage.

Fha Closing Costs Complete List And Estimate Fha Lenders

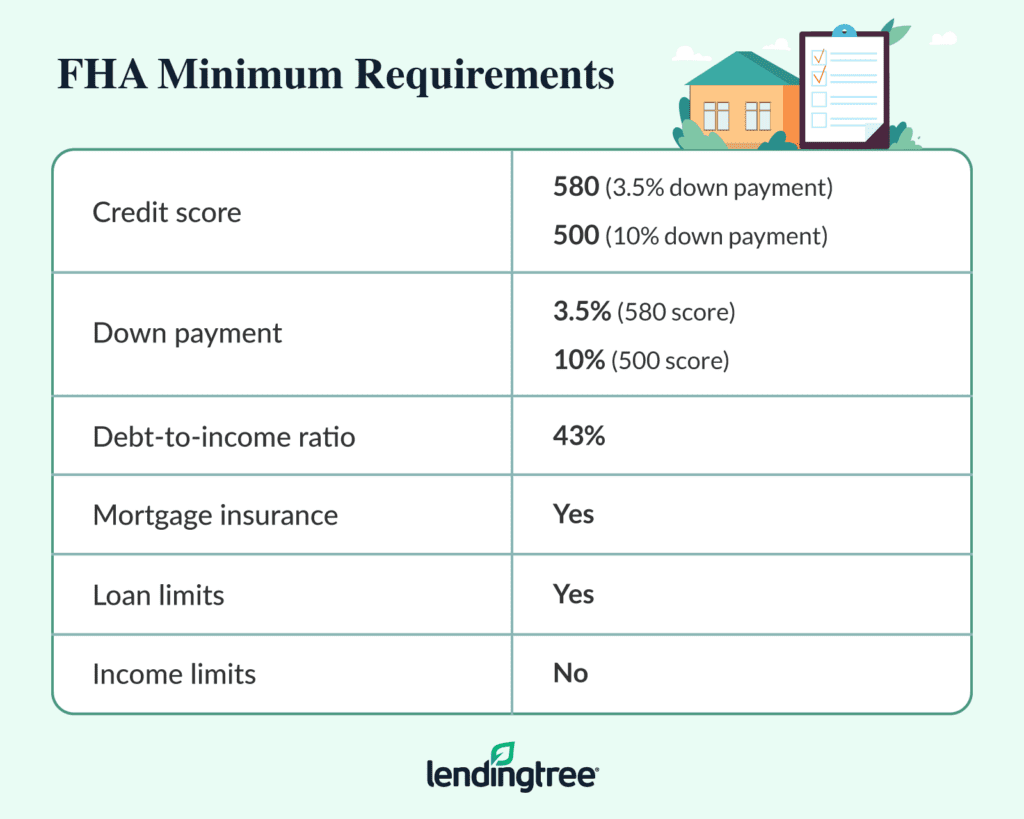

Fha Loan Requirements Limits And Approval Tips Lendingtree

Fha Closing Costs For 2021 Nerdwallet

What Fees Does The Seller Have When Selling To Someone With An Fha Mortgage

Are Fha Funding Fees Tax Deductible

What Costs Does The Seller Pay For An Fha Loan

Coming Home To Tax Benefits Windermere Real Estate

Do Fha Loans Have Income Limits

Rocket Mortgage Vs Loandepot Which Mortgage Lender Is Best For You Nextadvisor With Time

Fha Closing Costs For 2021 Nerdwallet

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional What S The Difference

Wells Fargo Home Mortgage Review Nextadvisor With Time

What Costs Does The Seller Pay For An Fha Loan

What Fees Does The Seller Have When Selling To Someone With An Fha Mortgage

Do Fha Loans Have Income Limits For Borrowers

Garden State Home Loans Review Nextadvisor With Time

Are Fha Funding Fees Tax Deductible